Chandigarh November 27: Haryana has registered a significant growth rate of 30.54 per cent under Goods and Services Tax (GST) collection in the last four months from July 2019 to October 2019 during the financial year 2019-20 which is highest in the country. An amount of Rs 6,930 crore has been collected as GST during this period.

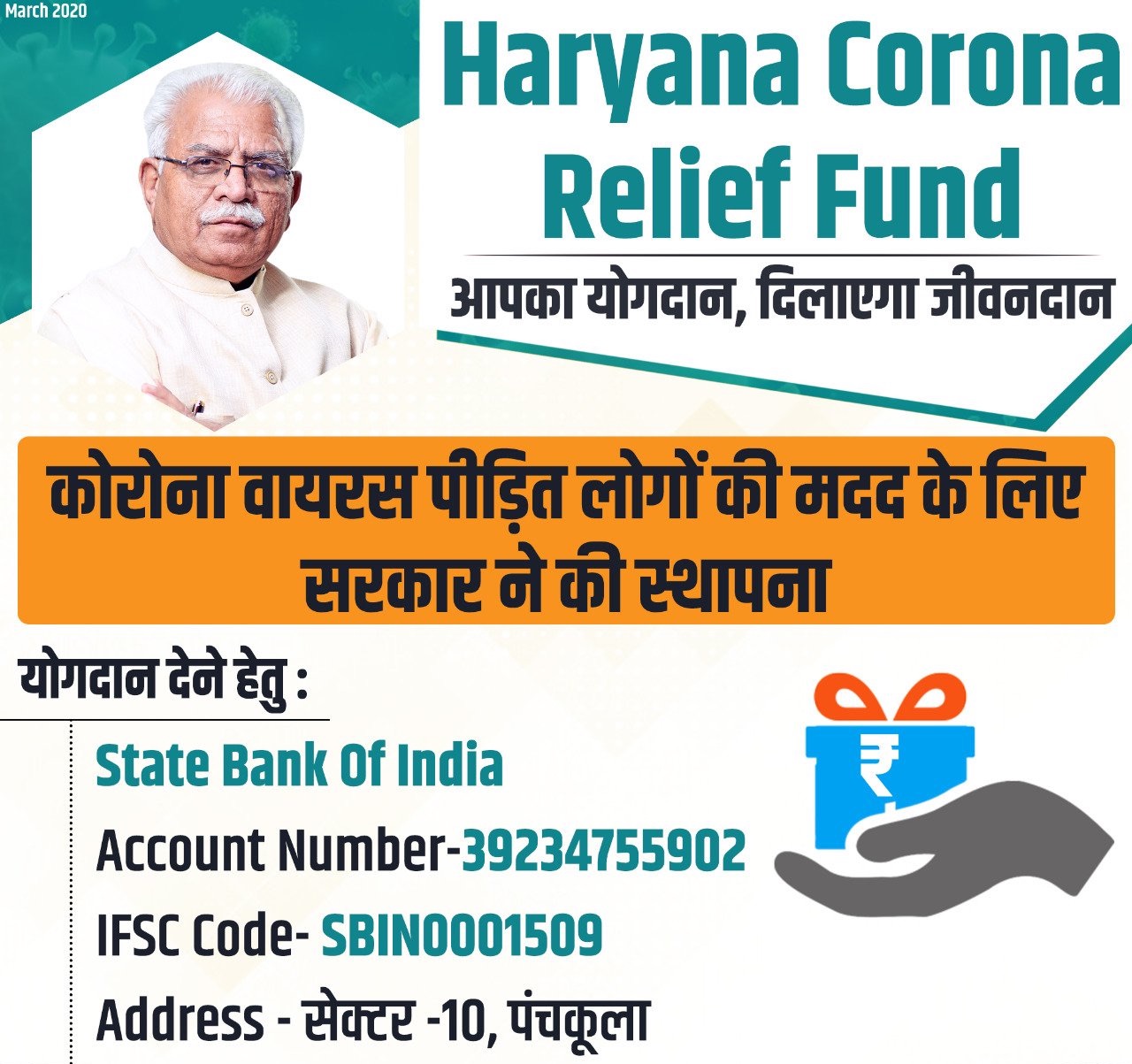

This was informed in a meeting presided over by Chief Minister, Mr Manohar Lal to review the functioning of Excise and Taxation Department here today.

The Chief Minister directed that with a view to check tax evasion and to improve GST Collection, a State-wide registration drive should be launched in the State for the registration of left out firms under the GST and also to cancel the registration of fake firms. Under the GST regime, a business whose turnover exceeds Rs 40 lakhs is required to register as a normal taxable person. He also directed the department to depute officers who would personally visit atleast 50 people in different districts that are registered dealers but did not file return so that reason for the same could be ascertained and accordingly steps could be taken.

It was informed that in order to check evasion of tax under the GST, the sale of registered dealers is reviewed regularly by the Tax Research Unit (TRU) of the Department by identifying any mismatch between the inward and outward supply and tax paid. It was also informed that 6,160 taxpayers have been identified who contribute nearly 80 per cent of the total state GST revenue. A special drive has been launched to pursue them to pay tax regularly and as a result of this, return has been significantly increased during the last four months.

It was also informed that the taxpayer base in the State has been increased from 2.25 lakh in VAT regime to 4.48 lakh taxpayers in GST regime. Apart from this, physical survey of 1,13,590 newly registered taxpayers were conducted out of which 16,967 were found non-existent or non functional. Registration of 12,314 had been cancelled.

It was informed that, for all new GST registrations, Haryana has mandated a physical survey or inspection within 15 days from the date of registration. It was also informed that as a result of the enforcement steps regarding the GST, the Department has recovered Rs 1,262.23 crore. As many as 2058 cases of Fake Transitional (Tran 1) have been detected by the Department and an amount of Rs 262.49 crore has been recovered. Similarly, 3,085 cases of Mismatch of GSTR-1 Vs GSTR 3B and 15,220 cases of Mismatch of GSTR2A Vs GSTR3B has been detected and amount of Rs 161.78 crore and Rs 284.37 crore respectively has been recovered. Likewise, 4,134 fake E-way Bills have been identified and Rs 451.75 crore has been recovered. Apart from this, out of the 1,13, 590 newly registered taxpayer surveyed, 16,967 tax payers have been found non-existent and Rs 63.12 crore has been recovered from them. In addition, 38.72 crore has been recovered on account of 4,325 cases of road side checking (penalty).

It was informed that Haryana contributed Rs 4602.56 crore per month in the Financial Year 2018-19 to the kitty of GST. The total collection of the State is Rs 55,231 crore . It was informed that the per capita GST collection for Haryana stands at Rs 21,744.49 in comparison with the national per capita GST collection at Rs 9370.33 making it approximately 2.5 times of the national average.

Among those present in the meeting included Additional Chief Secretary, Excise and Taxation Mr Sanjeev Kaushal, Additional Chief Secretary Finance Mr TVSN Prasad, Principal Secretary Irrigation and Water Resources Mr Anurag Rastogi, Additional Principal Secretary to Chief Minister Mr V. Umashankar, Excise and Taxation Commissioner Mr Amit Kumar Aggarwal, Deputy Principal Secretary to Chief Minister Mrs Ashima Brar and other senior officers of the Department.