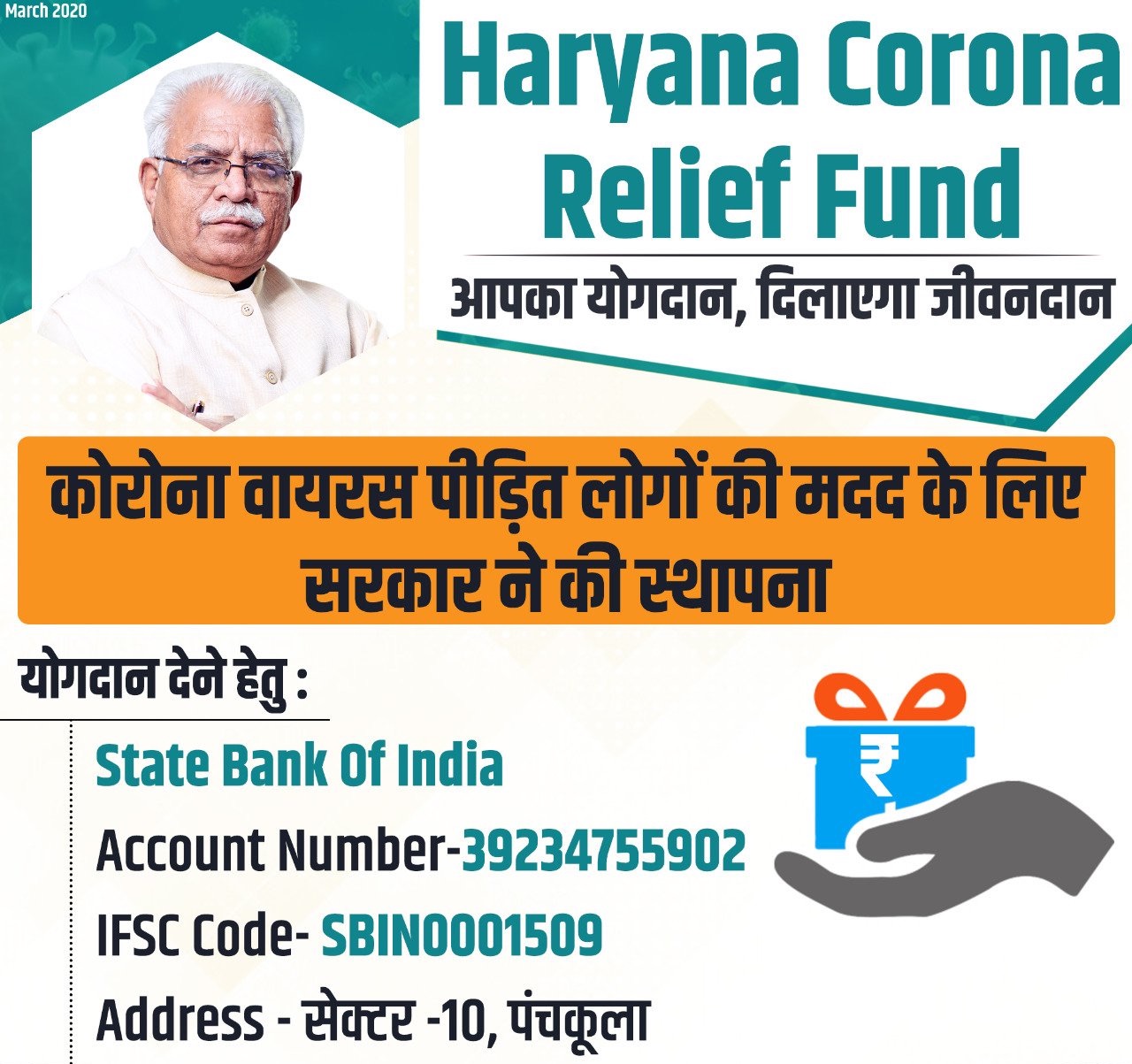

Chandigarh September 2: While giving a major relief to the loanee farmers of Cooperative Banks in the State, Haryana Chief Minister, Mr Manohar Lal has announced to waive off interest and penalty on the crop loans of such farmers to the tune of Rs 4,750 crore under the one time settlement scheme. This decision would benefit about 10 lakh farmers in the State.

Mr Manohar Lal who was addressing a press conference on the 12th day of ‘Jan Ashirwad Yatra’ in Bhiwani today also announced to extend the last date for payment of principal amount upto November 30, 2019.

The Chief Minister said that it would benefit the loanee farmers of Primary Agriculture Cooperative Societies, District Central Cooperative Banks and Haryana Land Reforms and Development Bank. He said that those farmers whose bank accounts were declared Non Performing Assets (NPA) by these banks and were unable to renew their loans, would now be able to change cycle of their crop loan accounts with this announcement. He said that the farmers would have to deposit their principal amount only. This one time relief has been provided to the farmers to dispose off their interest and penalty, he added.

He said that about 13 lakh farmers have taken loan from Primary Agriculture Cooperative Societies (PACS), out of which bank accounts of 8.25 lakh farmers have declared NPA. He said that 4 per cent interest on crop loans of PACS is borne by the State Government and 3 per cent by NABARD. He said that penalty at the rate of 5 per cent is imposed on those farmers who do not repay the crop loan on time, which would now be completely waived off. He said that while the State Government would bear 4 per cent amount of interest rate, out of 3 per cent interest rate of NABARD, 1.5 per cent each would be contributed by the State Government and PACS at their own level. With this announcement, the loanee farmers of PACS would be benefited to the tune of Rs 2500 crore, he asserted.

Mr Manohar Lal said that similarly, 85,000 farmers have taken loan of Rs 3000 crore from District Central Cooperative Banks. Out of this, accounts of 32,000 farmers of Rs 800 crore have become NPA. He said that to dispose of these accounts under the one time settlement scheme, principal amount alongwith simple interest would be payable from the date when the account was declared NPA upto November 30, 2019. According to this, simple interest would be charged at the rate of 2 per cent for loan less than Rs 5 lakh, 5 per cent for the loan of Rs 5 to Rs 10 lakh and 10 per cent for loan above Rs 10 lakh. It would benefit the farmers to the tune of Rs 1800 crore.

He said that in the third category, there are 1.10 lakh loanee farmers of Haryana Land Reforms and Development Bank out of which accounts of 70,000 farmers have been declared NPA. The principal loan amount of these farmers is Rs 750 crore while Rs 1400 crore is payable on account of interest and penalty. He said that the entire penal interest of farmers of these banks would be waived off. They would only have to pay 50 per cent of normal interest as the remaining 50 per cent would be borne by the State Government. The loanee farmers of Land Mortgage Bank would get benefit of Rs 450 crore from this scheme, he further added.

Mr Manohar Lal said that Prime Minister Mr Narendra Modi is committed towards making the farmers more prosperous and from the last two seasons, the Minimum Support Price (MSP) of crops has been announced with 50 per cent profit over and above the cost of production. He said that the procurement of paddy and wheat is made by Food Corporation of India (FCI) on behalf of the Centre Government whereas; other corps is procured by the State Government through its procurement agencies on MSP. He said that the MSP of Bajra has been declared Rs 2000 per quintal.

Among those present on this occasion included MP namely Mr Dharambir Singh, Nayab Singh Saini and Mr Sanjay Bhatia, Rajya Sabha MP Mr D.P. Vats, MLA Mr Ghansham Saraf, Media Advisor to Chief Minister Mr Amit Arya and other senior officers of district administration.